NordenBladet – China’s commitment to supporting its economy has boosted investor confidence and reduced concerns about an impending recession, leading to an improved outlook for companies in the industrial equipment and heavy machinery sectors, as well as those involved in the transportation of goods. The Dow Jones Industrial Average* has shown strong performance, outpacing both the S&P 500 Index and the tech-heavy Nasdaq 100 over the past month, marking its longest winning streak in over six years.

In Europe, the Stoxx Europe 600 index opened with little change, but shares in the basic resources sector saw a surge, driven by mining companies like Anglo American Plc and Rio Tinto Plc, which gained more than 3% due to an increase in metal prices following China’s recent stimulus commitment. On the other hand, health-care stocks lagged, with Bayer AG witnessing a 2.5% drop in its shares after cutting guidance. Notable individual movers included Unilever Plc, which climbed up to 5.1% following a sales beat, and Dassault Systemes SE, a French software maker, which saw a decline in its shares after delivering underwhelming results.

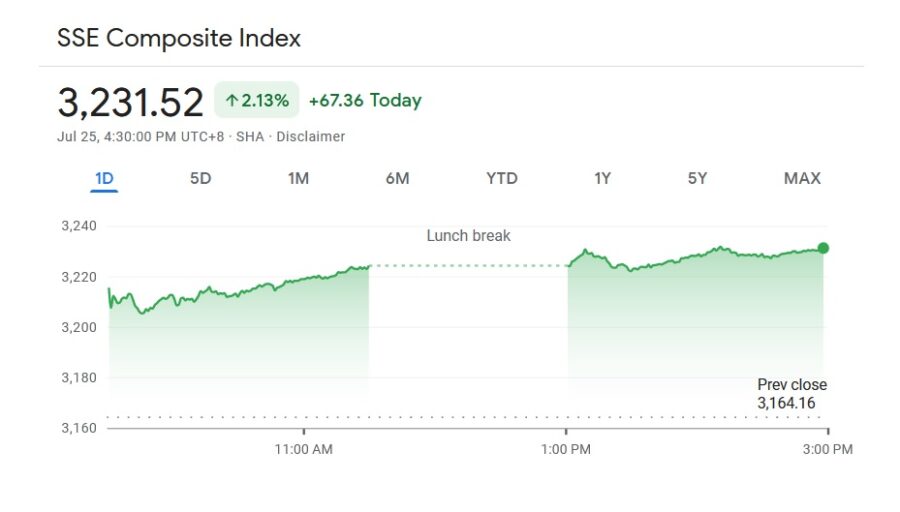

Chart: Chinese shares surge on Tuesday (25.07.2023). The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 170, 50 and 20 companies respectively, and the CSI 300 Index, which includes shares traded at the Shanghai Stock Exchange and the Shenzhen Stock Exchange. (graph excerpt from Google Finance)

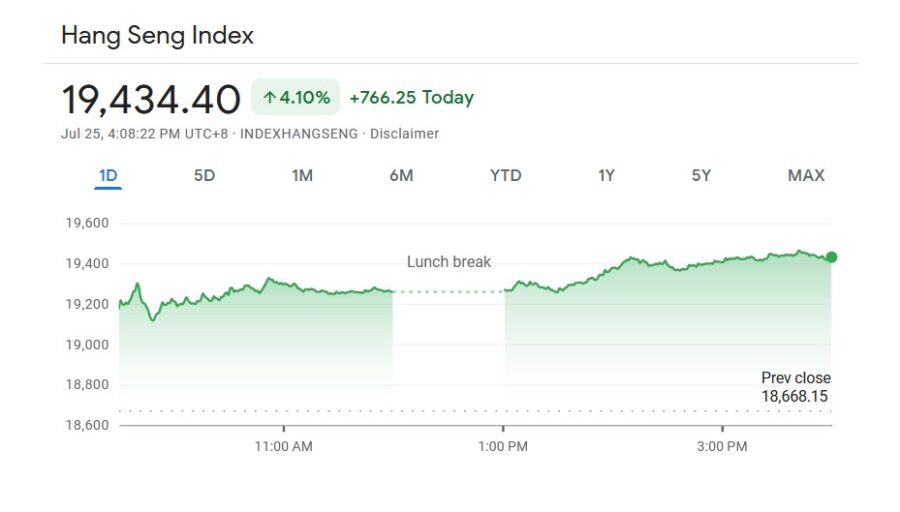

Chart: The Hang Seng Index is a freefloat-adjusted market-capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 66 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was started on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as Hang Seng China Enterprises Index, Hang Seng China AH Index Series, Hang Seng China H-Financials Index, Hang Seng Composite Index Series, Hang Seng China A Industry Top Index, Hang Seng Corporate Sustainability Index Series and Hang Seng Total Return Index Series. Hang Seng in turn, despite being a public company, is controlled by another listed international financial institution HSBC Holdings plc. (graph excerpt from Google Finance)

In the US, equity futures edged higher following a mixed session on Wall Street. While the S&P 500 posted a modest gain, the Nasdaq 100 experienced a decline after a “special rebalance.” Additionally, a gauge of emerging-market stocks saw its most significant increase in three weeks. Treasury yields remained flat, and the Bloomberg Dollar Index declined for the first time in six days.

Investors are closely observing key meetings of the Federal Reserve and the European Central Bank this week, as signs of a potential end to the cycle of aggressive policy tightening may have implications for the markets. The disappointing data from both the US and euro area on Monday provided fresh reminders of the negative effects of continuous rate hikes. However, China’s commitment to supporting its economy has lifted sentiment and offered some reassurance to investors.

______________________

* The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indexes. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500. The DJIA includes only 30 large companies. It is price-weighted, unlike stock indices, which use market capitalization. Furthermore, the DJIA does not use a weighted arithmetic mean.

Featured image: Unsplash