NordenBladet – Meme stocks have taken the financial world by storm this year, surpassing the performance of traditional S&P 500 stocks and attracting both retail and institutional investors. Stocks such as Carvana (CVNA), Coinbase (COIN), and Tesla (TSLA) have experienced remarkable gains, igniting a wave of interest and FOMO (Fear of Missing Out) among market participants.

“Has everybody lost their minds? It’s great that Carvana pulled off such a stock-goosing magic trick, but lost in all of the mania of the market is that the viability of the company’s business remains a question mark … and until proved otherwise, investing in Carvana continues to be a dash for trash. Keep in mind the stock tanked 98% in 2022,” wrote Herb Greenberg in Empire Financial Daily.

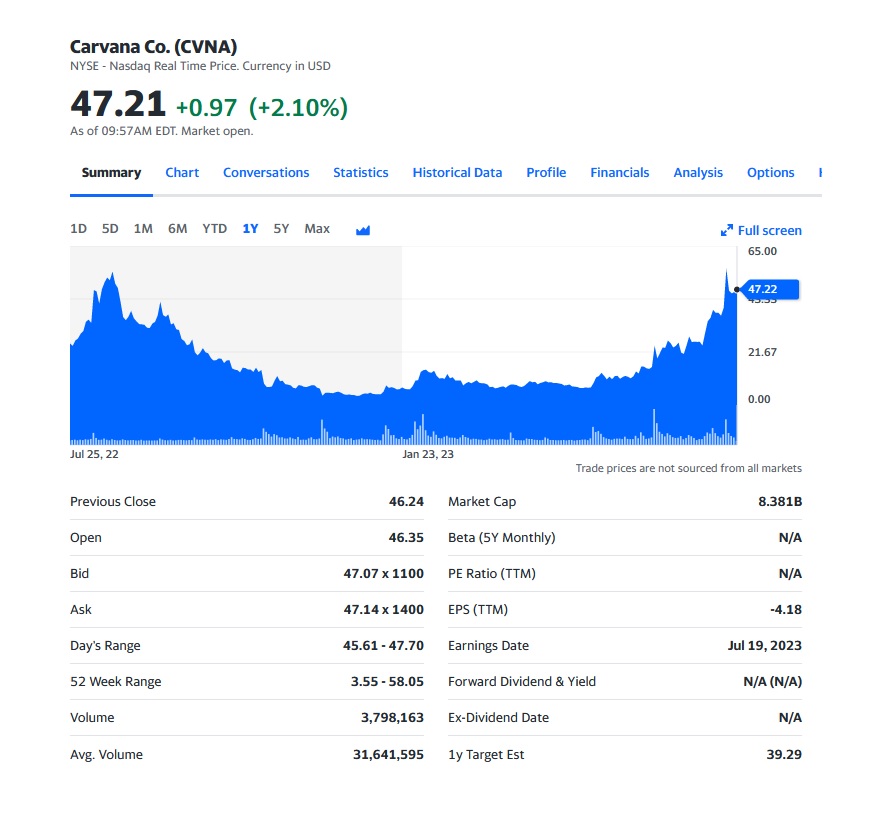

Chart: One-year summary of Carvana stock (taken 25-07-2023). Source: Yahoo Finance

But it’s not simply beginning investors capitalizing on the meme rush. The Roundhill Meme Stock ETF (MEME) has surged by an impressive 61% year-to-date, and even established players like ARK Innovation ETF (ARKK) and ProShares Bitcoin Strategy ETF (BITO) have benefitted from the speculative excitement.

However, with rapid growth come questions about the sustainability of these gains and the potential risks involved.

Biggest Meme Stock gainers:

| Company | Ticker | 2022 | YTD % ch. | Sector |

|---|---|---|---|---|

| Carvana | (CVNA) | -98.0% | 875.7% | Consumer Discretionary |

| Riot Platforms | (RIOT) | -84.8 | 413.7 | Information Technology |

| Marathon Digital | (MARA) | -89.6 | 377.9 | Information Technology |

| Upstart Holdings | (UPST) | -91.3 | 307.5 | Financials |

| Coinbase Global | (COIN) | -86.0 | 179.5 | Financials |

| DraftKings | (DKNG) | -58.5 | 168.7 | Consumer Discretionary |

| Palantir Technologies | (PLTR) | -64.7 | 154.3 | Information Technology |

| Carnival | (CCL) | -59.9 | 121.2 | Consumer Discretionary |

| Tesla | (TSLA) | -65.0 | 118.5 | Consumer Discretionary |

| SoFi Technologies | (SOFI) | -70.8 | 104.9 | Financials |

What Is a Meme Stock?

A meme stock refers to the shares of a company that have gained viral popularity due to heightened social sentiment. This social sentiment is usually due to activity online, particularly on social media platforms.

History

Interest in meme stocks started in 2020, in what the U.S. Securities and Exchange Commission has called a “meme stock phenomenon”. The stock of American video game retailer GameStop has been one of the most popular meme stocks, with mass purchases of the stock leading to the GameStop short squeeze in early 2021. The stock of entertainment company AMC is also cited as a prominent example.Other examples include the stocks of Bed, Bath & Beyond, National Beverage, and Koss.The distinction between a meme stock and a non-meme stock is not always clear; for example, Tesla has some of the characteristics of a meme stock: a high price-earnings ratio and being frequently discussed by amateur retail traders on social media, yet some professional analysts do not consider it to be overpriced.

Interest in meme stocks is associated with trading platform Robinhood, which pioneered commission-free trading. According to The New York Times, “Robinhood was the tool of choice for traders in the original meme stocks”.

Some meme stocks have often become popular among retail investors after being targeted by short-selling professional investors, such as hedge funds,with participants having the explicit aim of causing losses among those firms. News coverage has described the choice to purchase such stocks as an act of rebellion intended to humble short-selling professional investors.

According to an SEC report, while some hedge funds had big losses, the meme stocks phenomenon did not widely impact hedge funds.The SEC staff report also stated, “some investors that had been invested in the target stocks prior to the market events benefitted unexpectedly from the price rises, while others, including quantitative and high-frequency hedge funds, joined the market rally to trade profitably.” By June 2021, according to Financial Times, some hedge funds were systematically analyzing meme stocks.