NordenBladet – A third crypto-focused company may soon join the prestigious list of the largest publicly traded companies in the United States — the S&P 500 index. If market expectations and speculation hold true, the company formerly known as MicroStrategy — now operating under the name Strategy (Nasdaq: MSTR) — could officially become an S&P 500 constituent as early as this week.

If it happens, Strategy would become the third crypto-centric company — following Brian Armstrong’s Coinbase (Nasdaq: COIN), the largest U.S. crypto exchange, and Jack Dorsey’s Block, Inc. (NYSE: XYZ), a Bitcoin-focused fintech firm — to join the coveted list.

A Third Crypto Company in the Elite Index

If Strategy is added to the S&P 500 index, it would mark a significant milestone for the entire cryptocurrency sector. It would reinforce the growing role of Bitcoin as an asset class within traditional financial markets. To date, only two crypto-related companies have met the stringent criteria for inclusion — which include market capitalization thresholds, share liquidity, U.S. incorporation, and consistent profitability.

According to the official S&P Dow Jones Indices requirements, to qualify for the S&P 500, a company must:

-

Have at least 12 months of trading history on a major U.S. exchange

-

Maintain a market capitalization above $22.7 billion

-

Have at least 50% of shares publicly available

-

Report positive earnings in the most recent quarter and aggregate positive earnings across the last four quarters

-

Sustain a monthly trading volume of at least 250,000 shares

Strategy now appears to meet all of these criteria.

Strong Financials and Accounting Reform

The company reported remarkable results in the second quarter of 2025:

-

$14 billion in operating income

-

$10 billion in net income

-

$32.60 in diluted earnings per share (EPS)

A significant portion of this profit stems from unrealized gains on its Bitcoin holdings. Since adopting fair value accounting standards in January 2025, Strategy has been able to reflect Bitcoin price increases directly in its earnings reports — a major shift from the previously more conservative accounting treatment.

The Largest Corporate Holder of Bitcoin

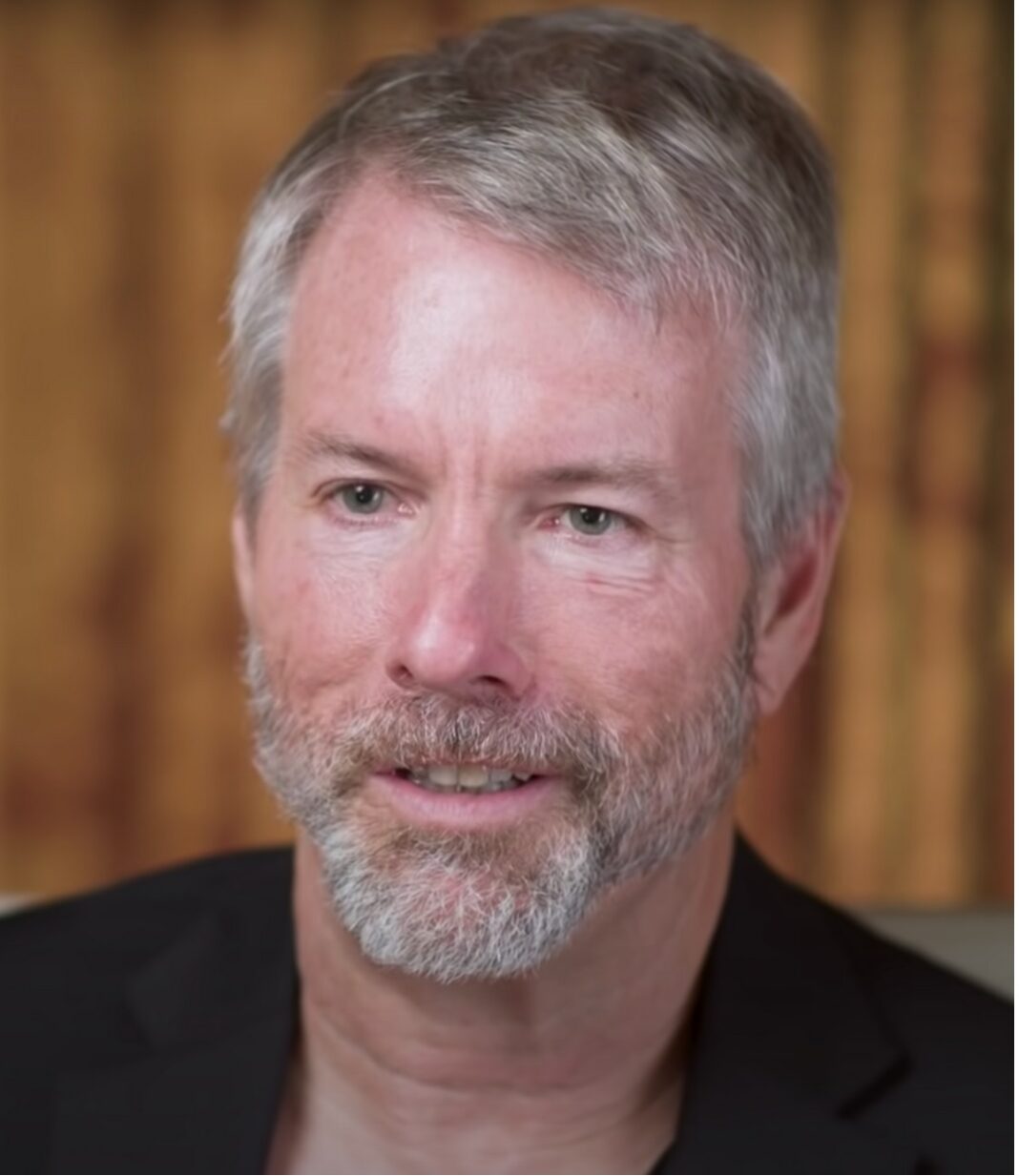

Strategy is led by Michael Saylor, co-founder and executive chairman, who has become one of the most vocal advocates for institutional Bitcoin adoption. The company currently holds a staggering 632,457 BTC, with a market value exceeding $69 billion — making it the largest publicly traded corporate holder of Bitcoin in the world.

Market Impact and Institutional Capital Inflow

Bitcoin investor and analyst Lark Davis stated on X (formerly Twitter) that Strategy’s inclusion in the S&P 500 could unlock billions in so-called “boomer money”:

“When it happens, billions in boomer money will start pouring into $MSTR and Bitcoin.”

This refers to capital from older generations — including pension funds and index-tracking investment vehicles — that are often bound to mirror the S&P 500’s composition. Once Strategy becomes part of the index, it would automatically attract substantial capital inflows — both into MSTR shares and, indirectly, into Bitcoin itself.

Crypto Assets Are Entering the Financial Mainstream

Strategy’s potential inclusion in the S&P 500 is more than just a symbol of corporate success — it’s a broader signal that crypto assets are steadily merging with traditional capital markets. If confirmed, this development could mark a major turning point in the trajectory of institutional Bitcoin adoption.

Header image: Michael Saylor (2022), CC BY 3.0 (via Wikimedia Commons)